BREAKING: New Bill to Strip IRS Agents of Guns and Ammo 4/16/25

The House introduced a Republican-backed bill to remove firearms and ammunition from IRS employees as the tax season concludes.

The Why Does the IRS Need Guns Act would prevent the IRS commissioner from purchasing or obtaining firearms and ammunition and mandate that the administrator of general services confiscates the IRS’s existing weapons.

The proposed legislation dictates that firearms should be sold or auctioned to licensed gun dealers while ammunition will be auctioned to the general public.

The funds collected would be deposited directly into the Treasury’s general fund to address the national deficit exclusively.

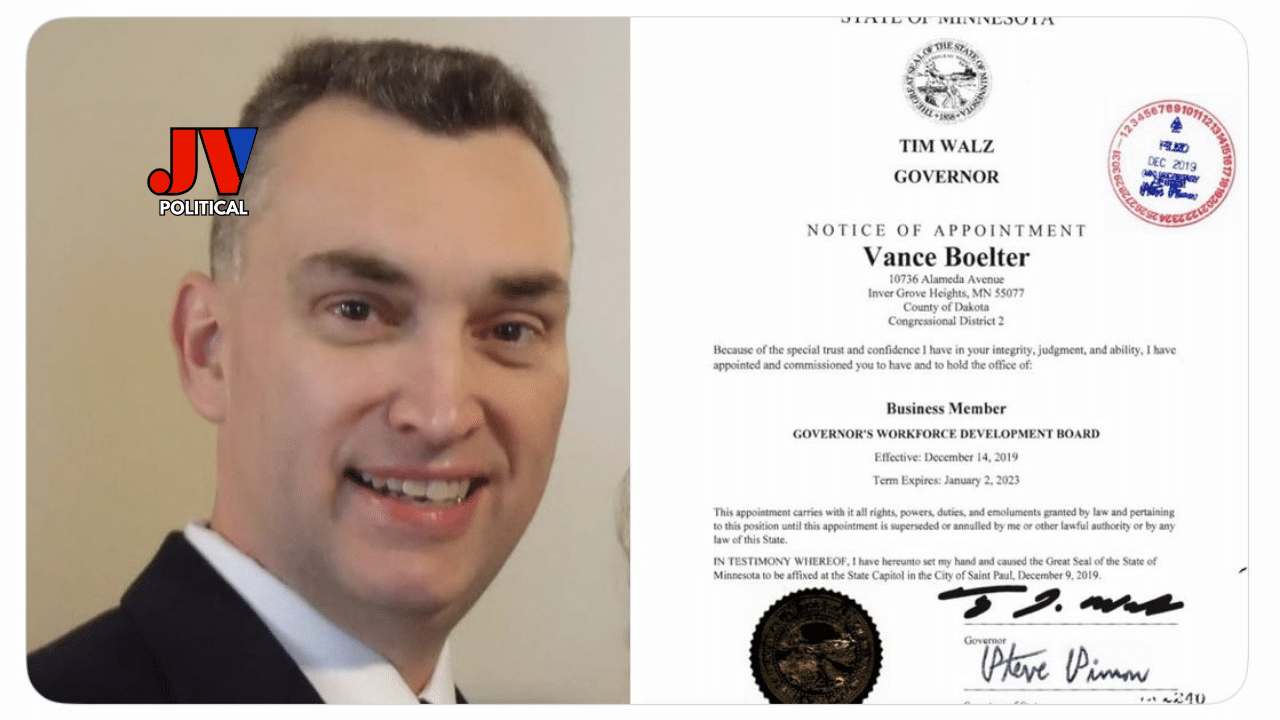

The legislation to disarm the IRS was introduced by Rep. Barry Moore, R-Ala., with Republican Reps. Harriet Hageman of Wyoming, Mary Miller of Illinois, and Clay Higgins of Louisiana serving as cosponsors.

According to Moore’s press release the IRS has frequently been used as a tool against various types of American citizens.

The IRS continues to operate as a tool of attack against American citizens along with religious groups and journalists and gun owners as well as regular Americans. Moore made it clear through his statement that arming these agents fails to enhance American public safety.

Key Takeaways

- The proposed bill focuses on limiting IRS agents’ access to firearms and ammunition.

- Conservative lawmakers are rallying behind the legislation as part of a broader effort to ensure accountability.

- Increased scrutiny of federal law enforcement practices is at the forefront of national discussions.

- This legislation highlights the importance of traditional values in governance.

- Political figures like Donald Trump are influencing the narrative around government oversight.

- Citizens are urged to pay attention to the balance of power between the government and individual rights.

Overview of the Proposed Legislation

The “Why Does the IRS Need Guns Act” is a response to the IRS’s growing use of weapons. It aims to address concerns about armed IRS agents. Supporters say it’s needed to protect American values and freedoms.

Introduction to the “Why Does the IRS Need Guns Act”

This bill wants to remove all guns and ammo from the IRS. It would shift the IRS’s enforcement duties to the Department of Justice. This change is meant to limit the government’s reach in people’s lives.

Key Objectives of the Bill

The main goals of this bill are:

- Stop the IRS from buying or keeping weapons or ammo.

- Move all IRS guns to the Administrator of General Services.

- Make federal laws clearer and more fair for taxpayers.

Initial Reactions from Lawmakers

Lawmakers have mixed opinions on the bill. Republican supporters say it’s needed to protect taxpayers from armed IRS agents. Critics argue the IRS should only collect taxes, not enforce laws with guns.

Bill Seeks to Strip IRS Agents of Guns and Ammo

The proposed legislation wants to change how the IRS enforces laws. It plans to move enforcement powers from the IRS to the Department of Justice. This move aims to make sure everyone is treated fairly and that our rights are protected.

Details of the Bill’s Provisions

This bill will take tax law enforcement from the IRS to the Department of Justice. It shows the need for a careful approach to enforcing tax laws. People will see fewer armed IRS agents, which they prefer for a more careful handling of tax issues.

Impact on IRS Operations and Enforcement

Changing how the IRS works will have a big impact. Without armed agents, the IRS will have to find new ways to enforce tax laws. This could lead to a better relationship between taxpayers and the IRS, as they work together more.

State of Federal Law Enforcement Authority

This change in power shows a bigger conversation about federal law enforcement. It tells people the government hears their concerns about too much power. We need to keep focusing on protecting our rights as we make these changes.

The Political Landscape Surrounding Gun Control and IRS Oversight

The relationship between gun control and IRS oversight has changed over time. Looking at the history of IRS arms raises important questions. It makes us think about the agency’s role and duties.

As a nation, we must consider the implications of an armed IRS. This is linked to our Second Amendment rights and the debate on government power.

Historical Context of IRS Armament

The idea of IRS arms is a big concern. The IRS was meant to enforce tax laws, not wield too much power. Laws now aim to limit the IRS’s use of force.

This change helps keep the IRS focused on its main job. It also shows our belief in a limited government.

Alignment with Second Amendment Rights

Removing guns from IRS agents supports our Second Amendment rights. This move helps protect us from government abuse. It shows we stand together against unfair control.

By doing this, we build trust in law enforcement. The law reflects our dedication to freedom. It ensures the government doesn’t scare us.

Conclusion

The “Why Does the IRS Need Guns Act” is important for our freedom as Americans. It helps keep our government in check and ensures it’s transparent. By removing guns from IRS agents, we make sure our government acts justly and with liberty.

This isn’t just about guns; it’s about keeping our country’s core values alive. We want a government that protects us, not scares us. This law helps us build a society where everyone feels safe and respected.

Protecting our rights is a job for all of us. We need to work together to keep our freedoms safe. Let’s stand strong for our freedom and tradition. This is our duty to protect our rights for future generations.

FAQ

What is the “Why Does the IRS Need Guns Act”?

This bill aims to take away guns and ammo from IRS agents. It wants to give these powers to the Department of Justice.

What are the key objectives of this bill?

The main goals are to stop the IRS from buying or keeping guns. It also wants to move any guns they have to the Department of Justice. Plus, it aims to keep an eye on the IRS’s actions.

Why is the bill necessary according to its supporters?

Supporters say it’s about keeping the government small. It helps protect our rights and stops the IRS from abusing its power.

How does the proposed bill impact federal law enforcement authority?

The bill wants to move the IRS’s tax enforcement to the Department of Justice. This ensures that tax law enforcement is handled correctly.

What reactions have lawmakers had to this proposal?

Lawmakers are really talking about it. Republicans think it’s good to protect taxpayers from armed IRS agents. They also believe the IRS should just collect taxes, not enforce laws.

How does this bill align with Second Amendment rights?

Supporters see it as a way to protect Second Amendment rights. They think it limits government power and stops the IRS from becoming too powerful.

What implications could this legislation have on taxpayers?

It could make the IRS more open and accountable. It might also protect taxpayers from the government getting too big. And it could help the country manage its money better.